Overview

Click to print charts in this section using PDF format

Totaling $5.3 billion, The University of Texas System Long Term Fund (LTF) is a pooled UT System investment fund for the collective investment of over 8,500 privately raised endowments and other long-term funds benefiting the 15 institutions of the UT System. Most gifts given to fund endowments are commingled in the LTF and tracked with unit accounting much like a large mutual fund. Each endowment or account purchases units at the LTF's market value per unit. Cash distributions are paid quarterly, on a per unit basis, directly to the UT System institution of record. Distributions from the LTF fund scholarships, teaching, and research across the UT System.

|

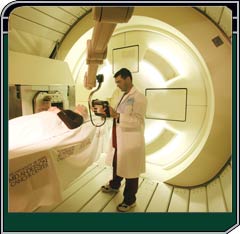

| The University of Texas M. D. Anderson Cancer Center |

In order to take advantage of lower unit costs, attractive investment opportunities, and broader diversification benefits available from a larger investment fund, the endowment assets in the LTF are invested in The University of Texas System General Endowment Fund (GEF), a broadly diversified pooled investment fund created by the UT Board of Regents in March, 2001, which is managed by The University of Texas Investment Management Company (UTIMCO). The LTF currently owns 84% of the GEF's $6.3 billion net asset value. LTF contributions are invested in the GEF on a quarterly basis. These contributions purchase additional GEF units at the prevailing market value price per unit. The other GEF unit holder is the Permanent Health Fund (PHF).