Letter from the Executive Management

Fiscal Year 2012 Returns

The Permanent University Fund (the �PUF�) and the General Endowment Fund (the �GEF�) � together the �Endowments� � had investment gains of 3.21% and 3.24%, respectively, for the fiscal year ending August 31, 2012. PUF assets totaled $13.5 billion and GEF assets totaled $7.1 billion. This represents all-time peaks for the Endowments.

The Endowments� actual returns slightly trailed the Policy Portfolio Benchmark by approximately .09%, or 9 basis points. As a reminder, the Policy Portfolio Benchmark represents the returns that would result without UTIMCO staff, or, said another way, the returns from investing at each asset class� Policy Portfolio target weight and receiving the asset class� average returns. The Endowments would have outperformed the Policy Portfolio Benchmark by 2% if not for the defensive positioning of the Endowments due to staff�s concerns about the global economy and global capital markets.

Over the past three and five years, the Endowments actual returns have outperformed the Policy Portfolio Benchmark by 2.2% per year, resulting in approximately $525 million per year of additional resources for the UT and Texas A&M Systems.

UTIMCO assesses other endowments and institutional investors in order to identify �best practices�. UTIMCO has consistently performed in the top quartile, if not top decile, for all endowments, foundations and pension plans. As measured versus the top twenty U.S. endowments over the past five years, UTIMCO has performed at the median. It should be noted that the Endowments� portfolio is less risky than most large university endowments because of lower private investment exposure in order to ensure plentiful liquidity.

The Intermediate Term Fund (the �ITF�) totaled $4.9 billion as of August 31, 2012 and represents important assets for all fifteen UT System institutions. This fund returned 2.87% for the 2012 fiscal year and actual performance exceeded its Policy Portfolio Benchmark by 1.87%, producing $89 million of value-add.

Investment Strategy

UTIMCO�s investment strategy remains constant given our long-term mandate, while our implementation remains flexible in order to capitalize on capital market opportunities.

- We believe that a diversified portfolio produces the best risk-adjusted returns so we invest across asset classes, investment styles, geographies and other methods of differentiation.

- We believe that when it comes to investing, skill matters. Therefore, we continue to rely on �best in class� external investment managers. This is evident across all investment styles: More Correlated and Constrained (�MCC�; long only), Less Correlated and Constrained (�LCC�; hedge funds), and Private Investments.

- We have a bias towards value as we welcome a margin of safety in our investments.

- We believe in the long-term growth prospects of many emerging markets, but are mindful of shorter-term headwinds, valuations and the political and economic risks in these areas.

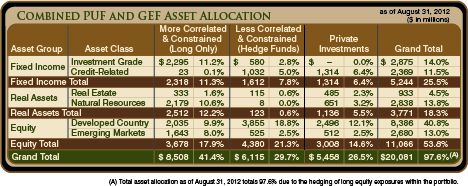

- We believe that equities will outperform fixed income over the long-term, particularly in areas with solid economic growth, so we retain an �equity orientation�. However, we also recognize that during certain periods of time, fixed income can provide extremely attractive risk-reward opportunities, so we are not rigid in our implementation of an �equity oriented� investment strategy. In fact, as of August 31, 2012, 25.5% of Endowments� assets were invested in fixed income securities.

- We believe that our portfolio will benefit from continuing to add exposure to real assets � natural resources and real estate � due to the attractive risk-reward opportunities of the individual investments, their portfolio diversifying effect, and their hedging of potential inflation pressures.

- We believe that as an �in-perpetuity� investor our long-term horizon allows us to assume prudent levels of illiquidity as long as we are appropriately compensated. We remain mindful about maintaining safe levels of liquidity from which to meet our obligations.

This year we engaged � as we do every year � in a thorough review of our Investment Policies with the UTIMCO Board of Directors and the Board of Regents of The University of Texas System, both of which helped shape and ultimately affirmed the Endowments� and the ITF�s investment strategies.

Click to print charts in this section using PDF format

Tactical Allocation and Portfolio Positioning

During Fiscal Year 2012, although actual investment performance almost equaled the Policy Portfolio in total, tactical asset allocation detracted 1.13% and our hedging �insurance� program detracted another .85% from investment returns.

Tactical asset allocation refers to staff�s positioning of the investment portfolio in specific asset classes over or under Investment Policy targets, always within the specified ranges. In short, because of staff�s concerns about the global economy and global capital markets, we continued to position the portfolio more defensively than the Policy Portfolio targets. The most straightforward measure of this �defensive� positioning is reflected in the portfolio�s risk exposure which totaled only 85% of the Risk Budget.

More specifically, slightly above target exposure to Private Investments and under exposure to Emerging Market Public Equity benefited the Endowments. Above target exposure in Investment Grade Fixed Income and Natural Resources and under target exposure in Real Estate and Developed Country Equity detracted from performance.

We believe a few highlights about our portfolio positioning may be of interest:

- We continue to believe in maintaining ample liquidity, via our MCC Investment Grade Fixed Income allocation, in order to meet our distribution and capital call obligations, as well as maintain flexibility in order to take advantage of short term opportunities when and as they arise.

- Within the MCC Natural Resources exposure is the Endowments� gold position, which was entered in 2010 and 2011, and now accounts for 4.5% of the Endowments� total assets. The remainder of the MCC Natural Resources portfolio is evenly divided between broad-based commodity strategies and natural resources-related public equities.

- The MCC Developed Country Public Equity exposure is generally comprised of managers who invest in high-quality, global companies as well as managers who typically invest in midcap and small cap companies that have a unique, defensible niche.

- MCC Emerging Market Public Equity assets consists of a diversified set of managers, with some investing globally across all emerging markets, some investing across emerging regions such as in Asia or the Middle East and Africa, and others investing in specific countries such as Brazil, China and Russia.

- LCC managers, or hedge funds, remain the single largest allocation for the Endowments, and held steady at 30% of total assets which is the target allocation. UTIMCO has a diversified portfolio of approximately forty LCC managers employing a variety of investment strategies including long/short equities, distressed securities, and global macro. Our LCC managers utilize modest levels of leverage, provide substantial transparency, practice strong risk management and generally approach investing with a value bias based on superior fundamental research.

- UTIMCO�s Private Investments increased from 25% of total assets at fiscal year-end 2011 to 27% at fiscal year-end 2012.

- One quarter of all Private Investments are in credit-related strategies that have shorter lives, employ less leverage, and have more downside protection.

- Thirty-one percent is invested in buy-out and growth capital in developed country small and mid-cap companies.

- Fourteen percent is comprised of venture capital investments which produced extremely strong returns over the past year.

- The remaining thirty percent of the private investment portfolio is in real estate, natural resources and emerging markets. This area of the portfolio accounts for the growth in the overall private investment portfolio over the past few years.

- During the fiscal year, UTIMCO received $1.1 billion in distributions from the private investment portfolio, sent $1.2 billion of capital to our general partners and made 35 new commitments totaling $1.9 billion in private investments.

Lastly, a tactical activity that bears particular mention is staff�s effort to protect the Endowments from severe drawdown should dramatic scenarios unfold. For example, in the event of a sovereign default, high U.S. inflation, or the severe slowing of emerging market growth � to name a few such negative events � staff forecasts that the Endowments� returns would be below investment objectives.

To protect against such scenarios, �insurance�, in the form of financial options, has been purchased. The maximum loss of such activities is known: it is the cost of the option. This cost would be realized should these scenarios not unfold; however, if the scenarios do not materialize the Endowments� returns should remain sufficient to meet their investment objectives. Should one or more of these dramatic scenarios unfold, the �insurance� would help offset likely losses.

While there is no �free lunch� the current cost of such �insurance� has been determined to be acceptable, given the severe and undesirable consequences of not having the �insurance� in place. This activity has been fully vetted with the UTIMCO Board and the UT System Board of Regents, and is carefully monitored and reported in detail to the UTIMCO Board.

Active Management

Active management refers to the actual returns generated by our third party investment managers relative to the average returns in their respective markets. These efforts generated approximately 2.17% of �value-add� or approximately $300 million of additional assets for the Endowments and ITF during the fiscal year.

Our active MCC Investment Grade Fixed Income managers outperformed their benchmark or market averages by 1.9%, which is stellar performance in this asset class.

MCC Real Estate managers generated a 9.5% return versus their market average of 11.8%. UTIMCO�s REIT managers have a value bias which was not rewarded over the past year.

MCC Natural Resources managers generated a -8.7% return, slightly lagging their market average return of -7.6%. UTIMCO�s natural resources-related public equity managers � again with a value bias � lagged their markets while our broad commodity managers outperformed their benchmarks.

MCC Developed Country Public Equity managers delivered an 11.4% return, exceeding their market average or benchmark return of 8.1%. This part of the portfolio has shown great progress over the past few years and we expect the outperformance to continue. MCC Emerging Market Public Equity managers produced returns of -2.6%, also exceeding their benchmark return of -5.8%. Much progress has been made in this part of the portfolio and we are confident that the progress will continue.

LCC managers continue to outperform the market average, posting returns of 6.6% versus the average hedge fund of fund return of -.6%. UTIMCO�s LCC portfolio consistently outperforms its benchmark and produces top quartile results.

Private Investment managers produced a 7.1% return, versus a market average 10.1% return. Strong gains in natural resources and venture capital were partially offset by smaller losses in real estate, emerging markets and buy-outs. Our Private Investment portfolio is still young and performance lags in the early years of private investment funds.

FY 2012 Market Overview and Market Outlook

Capital markets were volatile during the past twelve months as investors vacillated between �risk on� and �risk off� postures.

During the first quarter of the fiscal year � September, October and November 2011 � equities fell sharply in September, rose sharply in October and fell again in November. The quarter ended with all major capital markets down except the S&P 500 Index up 3%, spot oil prices up 13% and inflation-linked bonds or TIPS up 2%.

The second fiscal quarter had strong capital market gains as the �risk on� trade persevered, with only natural gas spot prices down -31%. Public equity markets rose from 6% for China to 22% for Brazil, with U.S. public equity markets up 10%. Bonds also posted gains from 2% for TIPS to 9% for high yield. Natural resources were up slightly by 1%, and REITs were up strongly at 12%.

Third quarter was �risk off� as only TIPs posted a positive return of 3%. Public equities were down from -1% in China and -4% in the U.S., to -22% in Europe and -30% in Brazil. Natural Resources down -13% and REITs down -3% were also off.

The fourth quarter was �risk on�, with all asset classes posting gains. Bonds rose from 1% for TIPS to 7% for high yield, REITS were up 10%, natural resources were up 14%, the S&P 500 Index was up 8%, Europe was up 14% and emerging markets were up an average of 6%.

For the year, bonds posted positive returns with TIPS and high yield outperforming the broad bond index. REITS were up 12% and natural resources were down -11%. The S&P 500 Index was up a very strong 18% and Europe was up 1% but Japan was down -5% and the emerging markets were down an average of -6%.

Our view of the next few years has not changed from the last few annual reports; we summarize our thoughts with the headline: �Long Workout, Long March�.

Developed countries � Europe, Japan, and the U.S. � are in a �long workout�. Over indebtedness requires that creditors and debtors �workout� of their situation. Four tools are generally available in a private workout: growth, austerity, asset sales and/or default/restructuring. A public workout, such as the one in which we find ourselves, includes these tools plus a fifth tool: monetization. While we expect all of these remedies to be used, we are most wary of monetization.

The ramification for our investment activities in developed countries is for us to focus on buying good assets at attractive prices from stressed sellers and/or with poor capital structures. We think U.S. real estate, as an example of one asset class, will provide ample opportunity for investment over the years to come.

Emerging countries are in a �long march� toward more participation in freer capital markets. Their journey, however, will not be fast, straightforward or without pitfalls. Most emerging markets continue to lack what we view as critically important societal fabric: such as truly democratic, participatory governance; governmental checks and balances; independent press; and other elements of a developed country. Markets that lack such political and social infrastructure pose heightened political risk for investors. In addition, many of these markets have attracted large amounts of opportunistic capital resulting in asset price increases.

The ramification for investment activities in emerging countries is for us to focus on opportunities that benefit from growing local consumer demand as well as the need for commercial infrastructure to support the supply of natural resources that these countries will demand. We seek to partner only with the best local investors and remain vigilant on pricing.

Importantly, UTIMCO�s philosophy is to take a bottom-up approach to �make one good investment at a time�. Our comprehensive and consistent engagement with managers across global capital markets positions us to take advantage of opportunities as they present themselves.

Board and Staff

The staff and Board are the keys to UTIMCO�s investment success. It is this team of people that produce the returns that provide additional resources for the state�s educational and health well-being.

We are grateful for Phil Ferguson�s many years on the UTIMCO Board which concluded this past year. Phil personified the definition of a great Board member. We welcome Morris Foster to our Board.

We are grateful for the open communications we have with our colleagues at the UT and A&M Systems and their respective institutions. In addition, we appreciate the oversight, direction and support we receive from the Regents.

We cannot express enough appreciation for all of our colleagues at UTIMCO. We have a great group of people who tirelessly apply their extraordinary skills to enhance the resources available to the public institutions that we serve.

We are pleased to have had a positive year of investment returns. We believe we are prepared for whatever the markets may offer and we are committed to doing our best, each and every day.

As always, we welcome your inquiries and input.

|

|

|

|

Bruce Zimmerman

Chief Executive Officer and

Chief Investment Officer

|

|

Cathy Iberg

President and Deputy

Chief Investment Officer

|